Discussing CASS, Market Surveillance and Section 166 Reviews

Earlier this month, Cappitech hosted its latest CFD Broker Compliance workshop. Widening out from recent focuses on transaction reporting and MiFID II, the breakfast event included presentations on other areas of compliance including handling Client Money, Market Surveillance, Financial Crime and the Section 166 process.

The event was hosted in the London offices of Willis Towers Watson, and included presentations from Asare Nicholls of Visie Limited and author of The Client Money and Assets (CASS) Blueprint: For CASS 6 & 7 Firms, Martyn Redfern, of Willis Tower Watson and Mark Spiers and Damon Batten of Bovill. Below are some of the key areas discussed.

Client Money and Assets (CASS)

The morning began with a discussion led by Asare Nicholls who explained current trends in CASS compliance, important items to consider and setting a CASS culture.

Among the current trends, Asare cited two main items the FCA is focusing on; technology/3rd party solutions used for client money supervision and CASS culture. The FCA focus on these two areas can be sourced to the regulator’s 2016 fines of both Aviva and Towergate.

In the case of Aviva, the insurance firm outsourced functions of client money administration to external firms. However, Aviva was found not to have adequate oversight of the outsourced solutions. As such, firms were urged to understand how the 3rd party technology or managed solutions worked. Rather than assuming a 3rd party solution is fully covering their daily CASS requirements, companies need to know what type of information is being analyzed and calculations made to ensure they are being compliant.

%20Asare%20Nicholls%20Speaking%20event%20(PS)-10.jpg)

Asare Nicholls of Visie Limited

In the case of Towergate, the firm was cited as having weak internal controls of handling and segregating client and company funds. This led to instances of client fund shortfalls being held by Towergate.

Asare explained that the takeaway for CFD brokers is to develop a “demonstratable CASS culture”. This includes daily checks for segregation of Retail and Professional client money, a method for handling excess collateral, proactive employee training and governance of CASS functions. Regarding governance, this included management being involved with reviewing CASS activities and at least an annual report to the board.

Financial Crime, Section 166 Process and Insurance

The morning moved to a discussion about areas of focus on the FCA when reviewing for financial crime and the Section 166 Process. Before going into the key details, Martyn Redfern introduced the subject of compliance related insurance. As FCA investigations include both company wide practices and focuses on individuals, it made sense for companies and compliance officers and directors to fully understand what their existing liability insurance does and doesn’t cover.

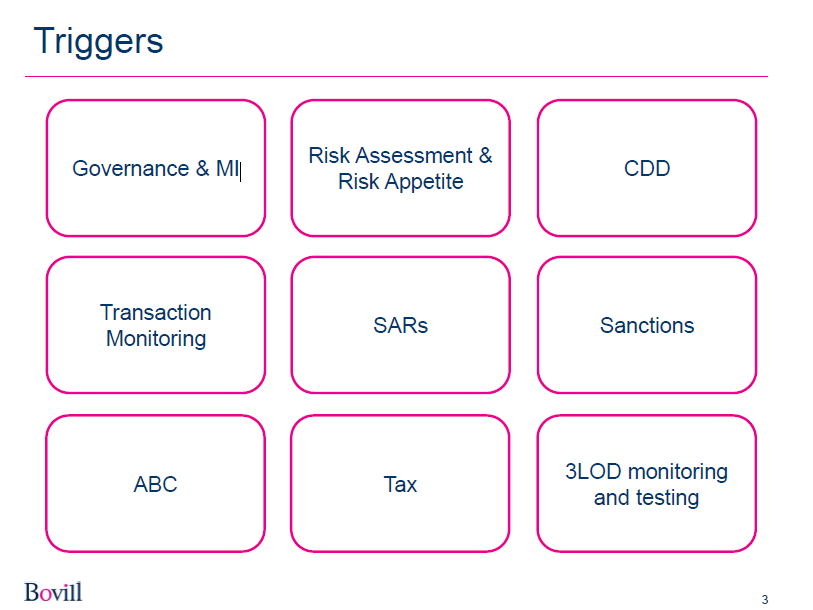

Next, Mark Spiers shared his and Bovill’s experiences of Skilled Person Section 166 reviews that they were appointed as the 3rd party reviewing firm. According to Mark, Financial Crime followed by Controls of Risk Management and Conducts of Business are the most common areas the FCA has requested 3rd party reviews to cover.

From their experience, Mark broke it down to nine specific areas the FCA reviews that can trigger the need for a Section 166 review. Among the main areas was Governance and Management Information (MI). Specifically, firms are being asked how compliance and regulatory activities are being handled and supervised. Also, how internal problems are raised to management and the board and fixed.

In addition, risk taking is an important area of focus of regulators. Companies need to show that they have set parameters are of their expected risk appetite and how it is being monitored.

Remediation and don’t lie

In the event that an investment firm is required to go through a Section 166, Mark explained that it was important to have a few foundation points before starting the review process and subsequent remediation. This includes a company choosing which people will lead the review; how they are empowered to push forward necessary changes; how management is involved with the process; and reviewing and applying new technology to assist in the future.

In regards of what not to do; Mark cited obvious cases such as not bringing the correct personal to audit meetings, responding late to review requests of information, lying and forgetting the purpose on the review. The latter is important as Mark explained that the point of a Section 166 is for an investment firm to come out of it in a stronger shape than before, and the 3rd party audit helps clarify the weak areas that need to be fixed.

Market Surveillance

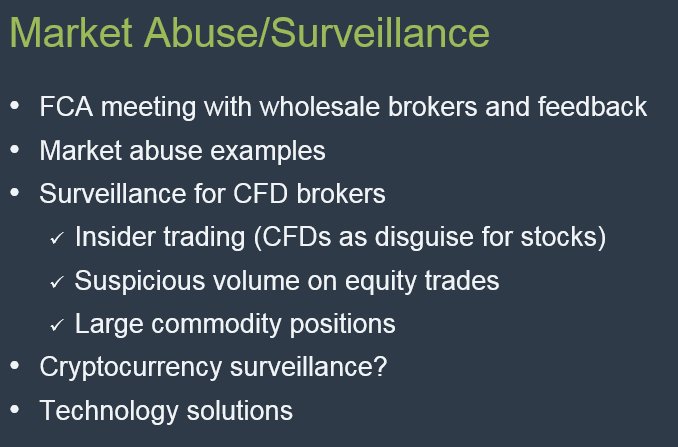

Concluding the event, we moved to Market Surveillance and Market Abuse Regulation (MAR). The discussion was led by Damon Batten and Cappitech’s Ron Finberg. From the perspective of the regulator, Damon explained that MAR has become an active area of focus of the FCA. Specifically, the regulator has been looking into the controls in place for brokers to monitor for market abuse of their clients.

The discussion then moved to the use of outsourced 3rd party market surveillance solutions as well as relying on internal non-UK/EU offices to monitor for MAR. When Interactive Brokers (IB) was fined for poor MAR controls in 2018, the FCA explained that the UK office relied on surveillance systems managed by the US entity. Damon explained that overall the FCA permits 3rd party solutions and non-UK surveillance, but in the case of IB, the UK office failed to ensure their existing systems met the needs for complying with MAR.

Also brought up was the application of MAR scenarios which is heavily focused on exchange traded products to CFD brokers. Among scenarios raised were monitoring suspicious stock CFD trades for insider trading and large sized positions in commodity CFDs.

In addition, despite CFDs being an OTC product a few broker attendees explained that they had received feedback from regulators that their surveillance systems should also monitor for scenarios where their customers are abusing them. Overall, there was a consensus that brokers should be proactive in both having a market surveillance system in place as well as continually documenting findings.

To learn more about Cappitech’s upcoming Market Surveillance solution for CFD Brokers or be alerted for our next compliance breakfast event, please Contact Us.